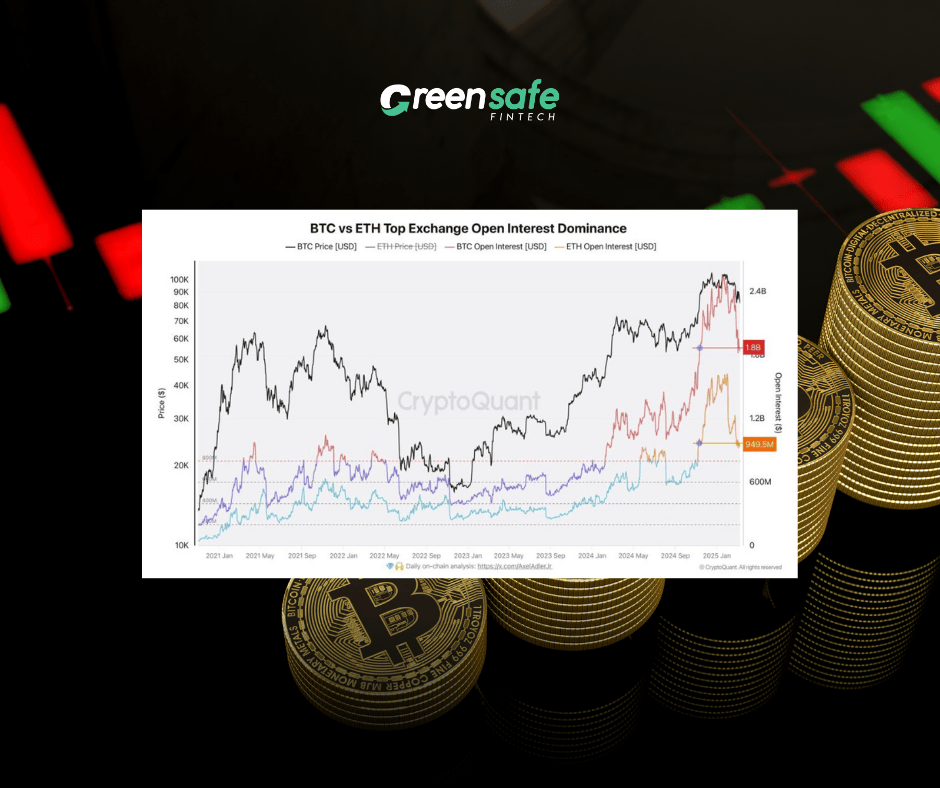

A CryptoQuant expert highlighted that the narrowing of Coinbase Premium could be a positive sign for Bitcoin’s (BTC/USD) long-term price action. Historically, this metric has been valuable for predicting Bitcoin’s movement toward new all-time highs (ATHs).

Coinbase Premium Signals: A Repeat of 2021’s Bull Market?

During the 2021 bull run, Coinbase Premium dynamics played a pivotal role in BTC’s ATH. A “triangular convergence” pattern, similar to a bullish flag, is forming again in 2024, as noted by pseudonymous CryptoQuant analyst Avocado Onchain. This convergence shows that Coinbase Premium’s upper and lower bounds are closing in, signaling potential bullish momentum.

What Does Coinbase Premium Convergence Mean for Bitcoin?

The Coinbase Premium Index tracks the percentage difference between Bitcoin’s price on Coinbase Pro and Binance, reflecting U.S. investors’ interest in purchasing Bitcoin. In past bull markets, similar triangular patterns appeared during consolidation phases, followed by massive price surges.

This may indicate that whales carefully assess the market before making their next move.

According to the CryptoQuant expert, the narrowing Coinbase Premium suggests an equilibrium between buyers and sellers, often a precursor to increased volatility.

Bitcoin Volatility Declines Amid Market Apathy

Bitcoin’s volatility has been decreasing as the market experiences apathy. In Q2 2024, Coinbase Premium dropped below -0.3 twice, showing pessimism among U.S. buyers. Over the past few days, BTC’s 24-hour volatility declined from 3.05% to 2.3%, indicating a slowdown in trading action.

As of now, Bitcoin is trading at $57,758, with a modest 0.1% increase in the last 24 hours, while its trading volume dropped by 15% overnight.