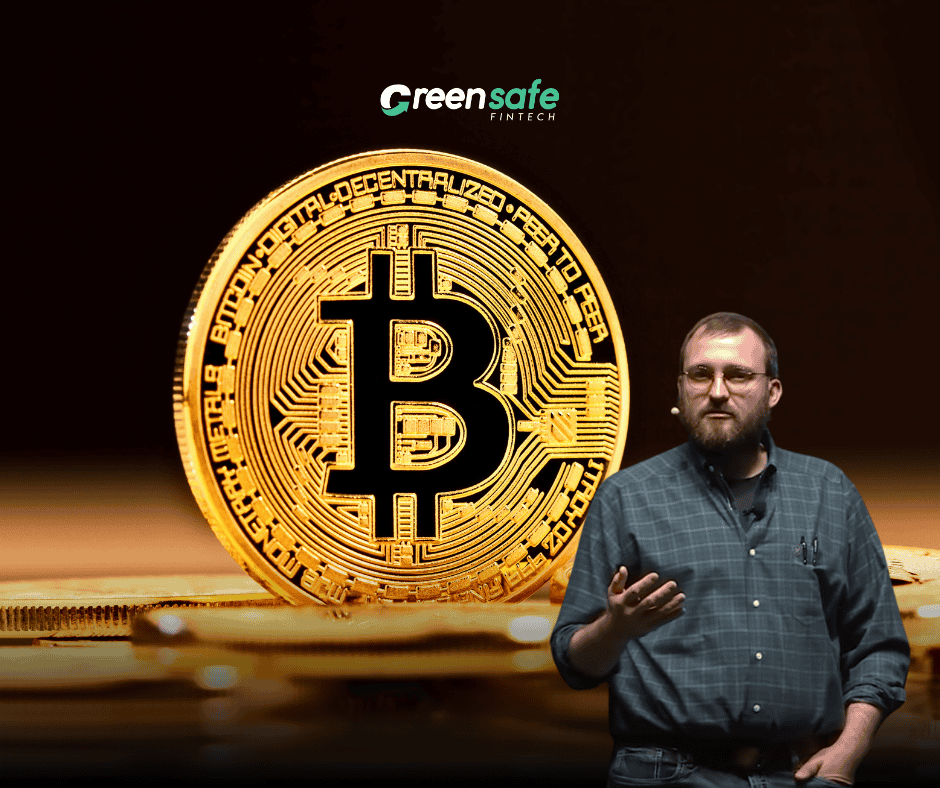

Charles Hoskinson, the visionary behind Cardano and co-founder of Ethereum, is making headlines again with a bold new prediction: Bitcoin could skyrocket to $250,000 by the end of this year or next. Despite ongoing market volatility and a recent dip in crypto prices, Hoskinson shared his bullish outlook during a recent CNBC interview, pointing to geopolitical turmoil and upcoming regulations as major catalysts.

“Crypto Is the Future of Globalization”

Hoskinson explained that increasing global tensions — from the Russia-Ukraine conflict to the risk of a China-Taiwan escalation — are shaking the foundations of traditional financial systems. With treaties losing credibility and centralized institutions showing signs of fragility, he believes the world will increasingly turn to decentralized alternatives like Bitcoin.

“Your only option for globalization is crypto,” Hoskinson stated. “If Russia wants to invade Ukraine, it invades Ukraine. If China wants to invade Taiwan, it’s going to do that. So treaties don’t really work so well, and global business doesn’t really work so well there.”

As traditional structures weaken, cryptocurrencies offer a censorship-resistant, borderless alternative to legacy financial systems.

Economic Forces and Crypto-Friendly Legislation Could Supercharge BTC

Despite a recent pullback that saw Bitcoin drop below $77,000, it quickly bounced back above $83,000. Still, it remains significantly off its January all-time high of over $100,000. Yet, Hoskinson remains undeterred, citing several strong macroeconomic and policy signals that could propel BTC to new heights:

- Interest Rate Cuts: Hoskinson suggested that if the Federal Reserve lowers interest rates in response to economic pressures, the influx of “fast, cheap money” could trigger a rush into digital assets.

- Big Tech Adoption: As regulation becomes clearer, companies like Apple, Microsoft, and Amazon could begin integrating crypto payments or services, especially via stablecoins.

- Pending Legislation: Hoskinson highlighted the upcoming Stablecoin Bill and the Digital Asset Market Structure and Investor Protection Act as game-changers. These measures could create a more stable and regulated environment, encouraging institutional entry.

“The stablecoin bill in particular could lead the ‘Magnificent 7’ companies to begin adopting the assets,” he said, referencing the likes of Apple, Google, Meta, and others.

What’s Next for Bitcoin?

Hoskinson expects the market to “stall for the next three to five months”, a cooling period that might be followed by a major speculative surge in late summer or fall 2025. Combined with improved regulation, growing public trust, and institutional momentum, he argues this could lay the foundation for Bitcoin to hit $250,000.

Whether or not BTC reaches that ambitious target, one thing is clear: the growing convergence of global politics, macroeconomics, and blockchain tech is reshaping the future of finance — and Charles Hoskinson believes Bitcoin will be leading the charge.