Bitcoin’s recent dip below the 200-day moving average (MA) has raised concerns, but one analyst highlights the 50-week MA at $75,195 as a crucial support level that historically marks the boundary of bear markets.

Bitcoin’s Moving Averages: A Critical juncture

Crypto analyst James Van Straten noted that Bitcoin has dropped below its 200-day MA, a level often considered the dividing line between bullish and bearish trends. However, BTC remains above the 50-week MA, which has historically signaled whether Bitcoin is entering a prolonged downturn.

- Bitcoin’s 200-day MA Breakdown: The recent sell-off pushed BTC below this key level, raising fears of further declines.

- 50-Week MA at $75,195: This moving average has acted as a long-term bear market boundary in previous cycles. As long as BTC stays above this level, bulls may still have a chance to regain control.

Van Straten noted that Bitcoin has previously dropped below the 200-day MA and recovered before breaching the 50-week MA, suggesting that history could repeat itself.

Leverage Flush: Derivatives Market Sees Major Liquidations

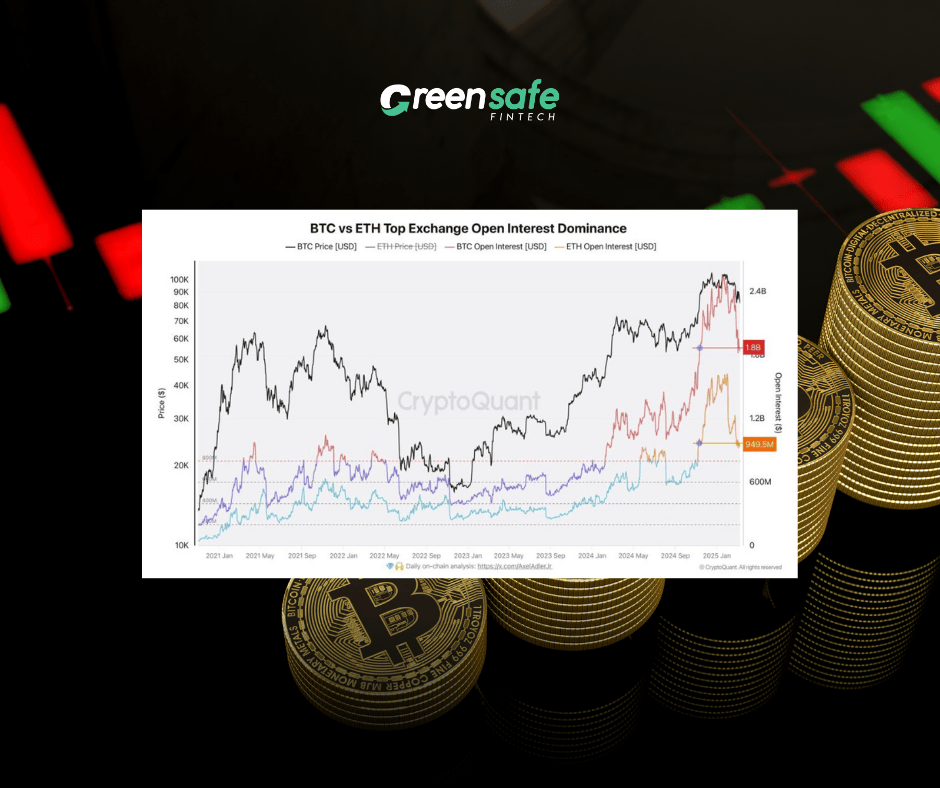

The recent price drop also triggered a massive reduction in open interest in the crypto derivatives market. Analyst Axel Adler Jr highlighted that:

- Bitcoin open interest dropped by $668 million, indicating that leveraged traders were liquidated.

- Ethereum saw an even steeper decline, with $700 million in positions wiped out.

Bitcoin’s Short-Term Recovery and Market Outlook

Despite recent turbulence, Bitcoin has rebounded 7% in the past 24 hours, climbing back to $83,000. The key question is whether BTC can hold above the 50-week MA or if another breakdown will lower prices.

As market watchers assess BTC’s next move, all eyes remain on key technical indicators and macroeconomic factors that could determine Bitcoin’s trajectory in the coming weeks.