What is Cryptocurrency?

Cryptocurrency is a secured digital or virtual currency on decentralized networks using blockchain technology.

Cryptocurrencies don’t require banks to verify the transactions; all transactions are verified and recorded on a blockchain. Cryptocurrency uses encryption to verify transactions and the purpose of this encryption is to provide safety and security.

According to experts blockchain technology can be used in many industries and processes for example JPMorgan Chase & Co which is a financial institution is using this technology to lower transaction costs.

Bitcoin was the first decentralized cryptocurrency created by Satoshi Nakamoto in 2009. According to bitcoin.org, “Bitcoin is open-source; its design is public, nobody owns or controls Bitcoin and everyone can take part.”

Are Cryptocurrencies Safe Investments?

Even though blockchain technology is generally secure and safe, due to the high losses, scams, volatility, and hackers Cryptocurrencies are considered a high-risk investment.

Many people don’t keep their digital assets on exchanges such as Coinbase or Binance, etc… and they believe that keeping the cryptocurrency on a centralized exchange means they won’t have full control over their assets and prefer to use other options such as hardware wallets like Ledger to store their cryptocurrency.

In addition to the risks of the cryptocurrency market associated with speculative assets, you need to be aware of other risks such as Regulatory risks, User risks, Volatility risks, etc.

- User risk: Due to the nature of blockchain technology you can not cancel or reverse a transaction after it has already been sent. Therefore, it is crucial to carefully verify the recipient’s wallet address before sending any cryptocurrency.

- Regulatory risks: The regulatory status of some cryptocurrencies is still unclear and most crypto-related activities are not regulated. It’s crucial to bear in mind that once your money is in the crypto ecosystem, there are no established regulations or safeguards to protect it, unlike traditional investments.

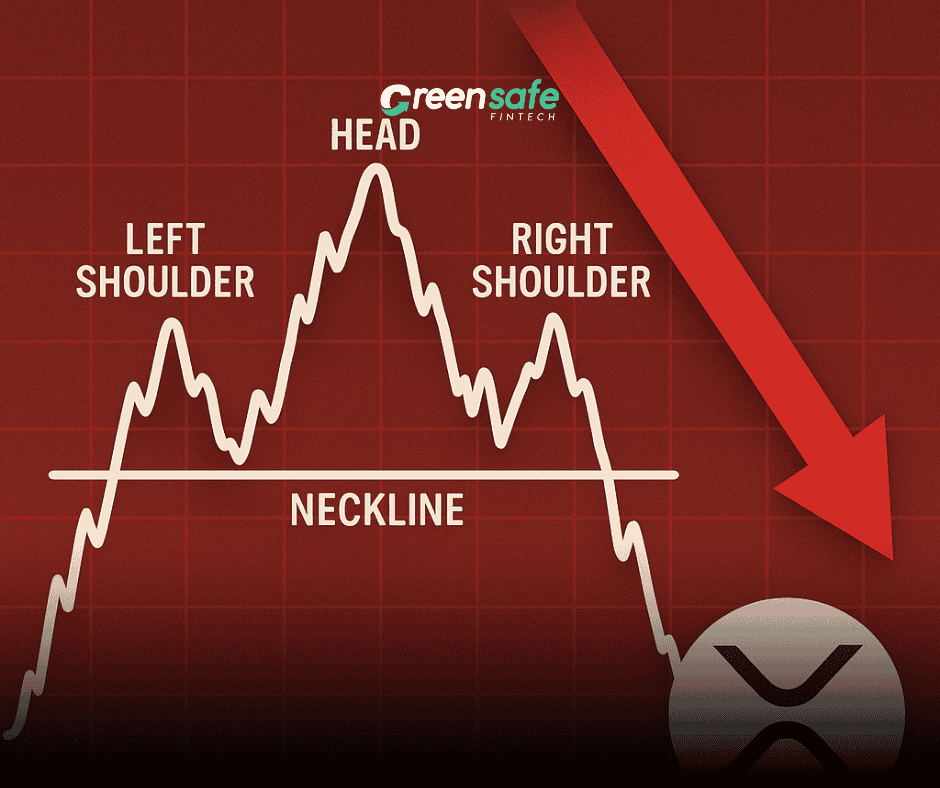

- Volatility risks: The price of cryptocurrency has shown to be very volatile, meaning it changes quickly and frequently from high to low without any warning.

Despite these risks, cryptocurrency investments can generate profits. cryptocurrencies have experienced a significant surge in price, and currently, the total market capitalization is approximately $2.62 Trillion.

By staying informed about the market dynamics, technological advancements, and regulatory landscape, investors can make more informed decisions, potentially maximizing returns and protecting their assets.