Asset management giant Franklin Templeton has filed for a multi-asset crypto exchange-traded fund (ETF) with the U.S. Securities and Exchange Commission (SEC). If approved, the Franklin Crypto Index ETF will provide investors with exposure to Bitcoin (BTC) and Ethereum (ETH) in a single fund on the Cboe BZX Exchange, weighted by their respective market capitalizations.

Quarterly Rebalancing and Potential Expansion

According to the Feb. 6 SEC filing, the ETF will be rebalanced and reconstituted quarterly (March, June, September, and December). As of the filing date, the fund’s composition was:

- 86.31% BTC

- 13.69% ETH

The firm hinted at the possibility of adding more crypto assets in the future, such as Solana (SOL), Avalanche (AVAX), and Cardano (ADA), but only after receiving necessary regulatory approvals.

Growing Demand for Crypto ETFs in the US

Franklin Templeton’s filing comes just weeks after Bitwise filed for a similar ETF on Jan. 31, highlighting the increasing interest in multi-asset crypto funds. Meanwhile, speculation around a Solana ETF continues to rise, although analysts like James Seyffart suggest it may not be approved until 2026, given the SEC’s lengthy review process.

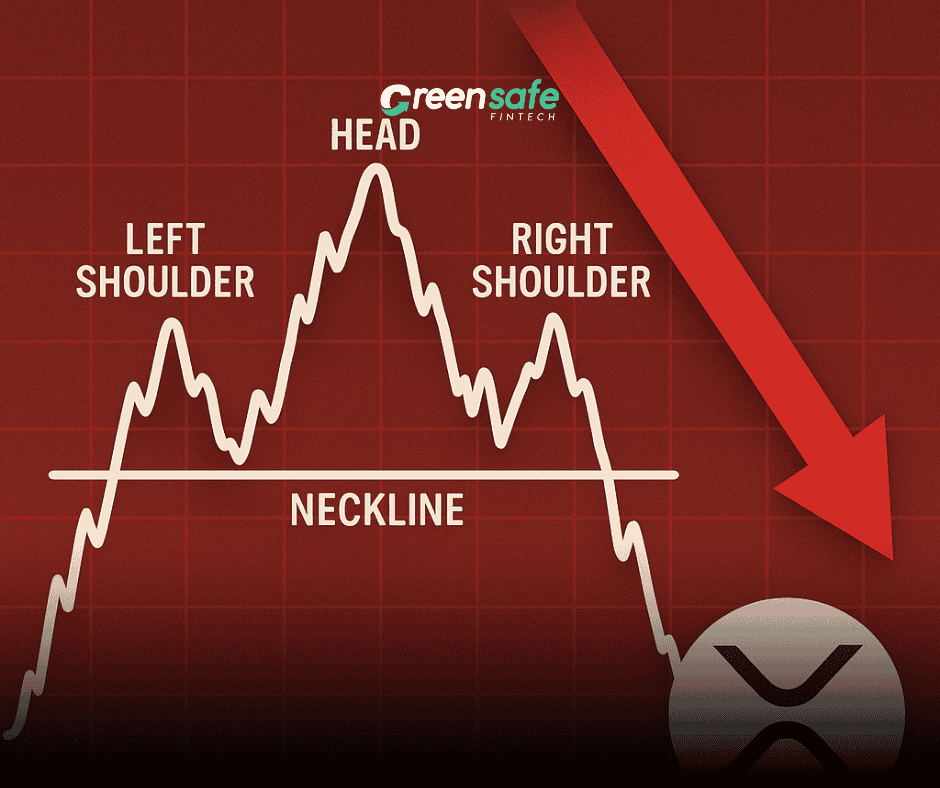

XRP ETFs Also in Play

On the same day as Franklin Templeton’s filing, the Cboe BZX Exchange submitted 19b-4 filings for four spot XRP ETFs from:

- Canary Capital

- WisdomTree

- 21Shares

- Bitwise

These filings mark a notable shift in SEC policy following the inauguration of President Donald Trump and the resignation of former SEC Chair Gary Gensler on Jan. 20. The new acting SEC Chair, Mark Uyeda, is seen as more crypto-friendly, potentially paving the way for further regulatory advancements.

What’s Next for Crypto ETFs?

With institutional interest in crypto ETFs surging, Franklin Templeton’s multi-asset ETF proposal could be a game-changer for investors seeking diversified exposure to digital assets. However, regulatory approval remains a critical hurdle, with the SEC yet to signal its stance on expanding ETF approvals beyond Bitcoin and Ethereum.

As the market watches closely, the rise of crypto ETFs could reshape institutional investment strategies and further legitimize digital assets in the traditional financial sector.