The cryptocurrency market is ringing in the new year with a powerful resurgence. Bitcoin (BTC) and the top 100 cryptocurrencies are witnessing steady upward trends, signaling renewed optimism for the sector. Crypto expert Miles Deutscher has shared his bold forecasts for 2025, touching on Bitcoin’s potential, altcoin growth, and the evolving role of AI and decentralized finance (DeFi).

Bitcoin’s Journey to $140K and Beyond

Deutscher predicts Bitcoin will reach $140,000 by the end of 2025, a substantial increase driven by its maturing market presence and increasing institutional adoption. While some forecasts place Bitcoin’s value above $200,000 in the same period, Deutscher considers such estimates overly ambitious in the short term.

Looking further ahead, he envisions Bitcoin evolving into a $1 million asset, underscoring its potential to become a global financial cornerstone.

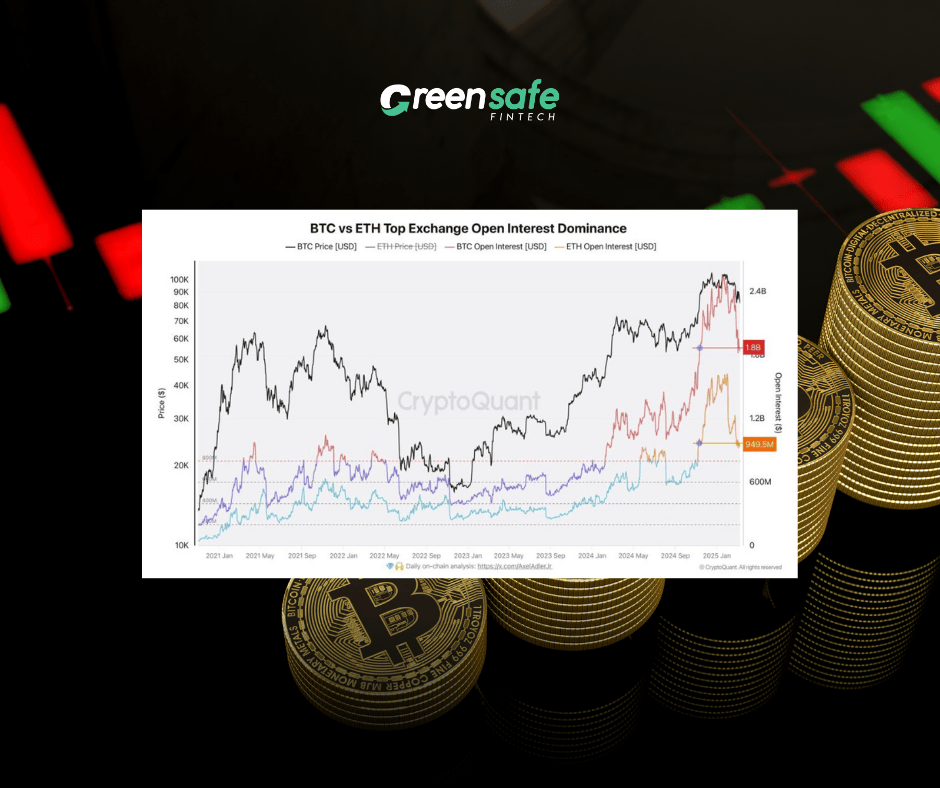

Bitcoin dominance, currently hovering near its peak, is expected to stabilize at 61.5% as the market diversifies and altcoins gain traction, particularly in the second half of the year.

Altcoin Seasonality and Emerging Trends

Deutscher emphasizes the cyclical nature of altcoin performance, suggesting two potential upward runs in 2025. He expects the year’s second half to see significant developments in altcoin markets as macroeconomic conditions stabilize.

Key altcoins like Chainlink (LINK), Aave (AAVE), Enjin (ENA), and Uniswap (UNI) are projected to outperform, driven by their DeFi utility and income-generating capabilities.

AI and DeFi: A New Crypto Narrative

Artificial intelligence is poised to reshape the cryptocurrency landscape in 2025. Deutscher predicts AI will play a transformative role in DeFi and on-chain trading, with AI-driven projects likely to achieve billion-dollar market capitalizations.

Real World Assets (RWA) are another burgeoning sector. Deutscher anticipates significant growth in asset tokenization, with prominent figures like Donald Trump and Larry Fink championing this innovation.

The Rise of Cryptocurrency ETFs

2025 is set to mark a turning point for cryptocurrency exchange-traded funds (ETFs). Deutscher believes that favorable regulatory changes will pave the way for ETFs tied to assets like Solana (SOL) and XRP, further legitimizing the sector.

Moreover, the potential establishment of a strategic Bitcoin reserve in the United States could trigger a global trend of sovereign adoption, reinforcing Bitcoin’s position as a viable asset class.

A Bullish Year Ahead

The combination of Bitcoin’s stability, altcoin opportunities, AI integration, and regulatory advances sets the stage for a transformative year in crypto. With bold predictions like a $140K Bitcoin and the rise of DeFi utility protocols, 2025 could redefine the market’s trajectory and cement cryptocurrency as a cornerstone of modern finance.